Cawö Strandtuch Campus DO ALL THINGS WITH LOVE 840 - 70x180 cm - Farbe: watermelon - 20 - 70x180 cm | Strandtücher | Handtücher | Cawö

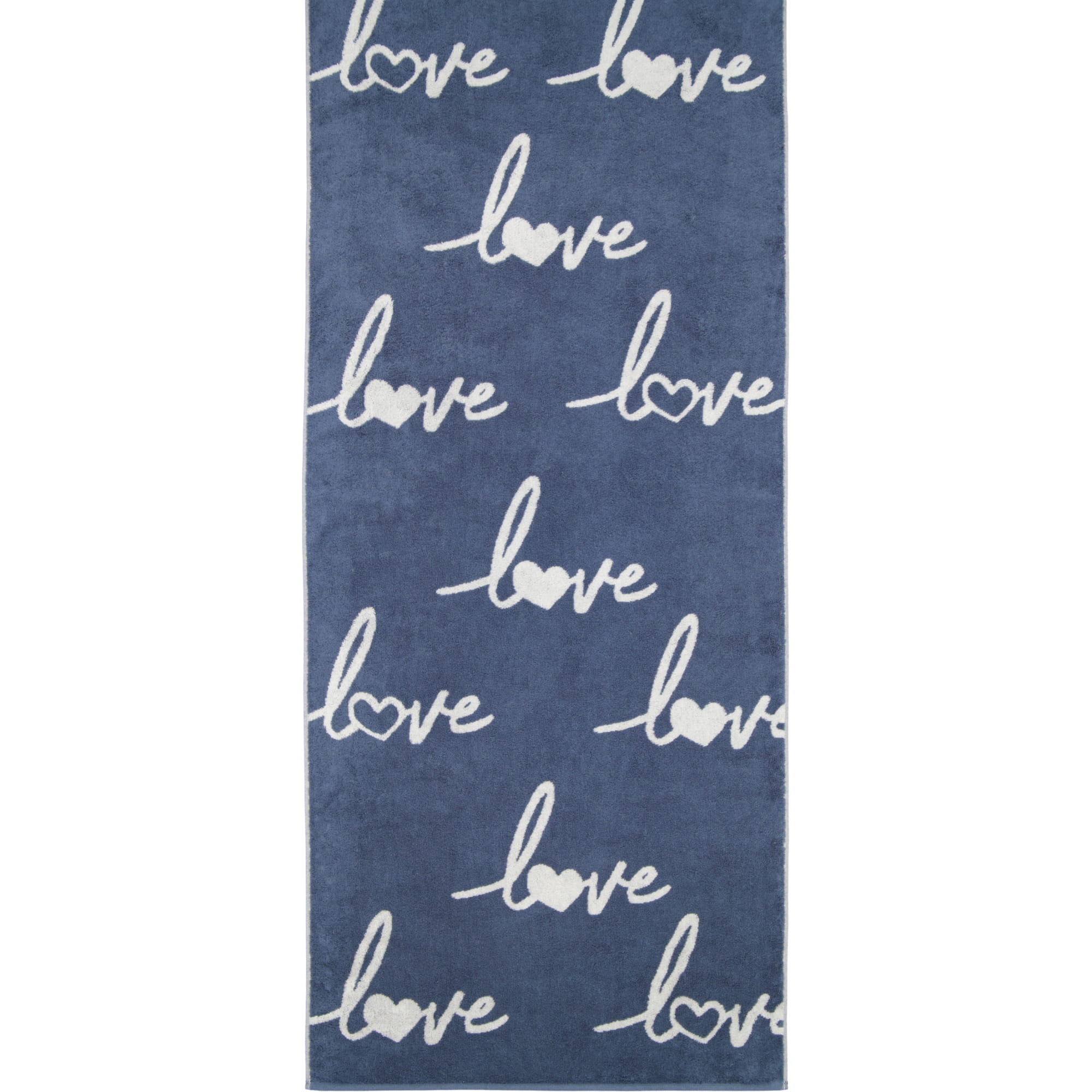

Cawö Strandtuch Campus LOVE LOVE LOVE 835 - 70x180 cm - Farbe: nachtblau - 17 - 70x180 cm | Strandtücher | Handtücher | Cawö

Mediterranes Strandfeeling ♥ Cawö Strandtuch Beach Palmen 5553 blau-grün 80 x 180 cm | Bett und so...

Cawö Strandtuch Beach 5560 Eis 80x180 cm - Farbe: apricot-gelb - 25 - 80x180 cm | Strandtücher | Handtücher | Cawö

Cawö - Badetuch Code Hamam Blockstreifen 5503 - 90x180 cm - Farbe: pink - 23 | Strandtuch | Handtücher | Handtuch-Welt.de