OneTouch Ultra Plus Reflect Starter Set mg/dL: 1 Messgerät, 60 Teststreifen, Lanzettengerät und Lanzetten im Etui. Damit Sie Ihren Blutzucker in den Griff bekommen : Amazon.de: Drogerie & Körperpflege

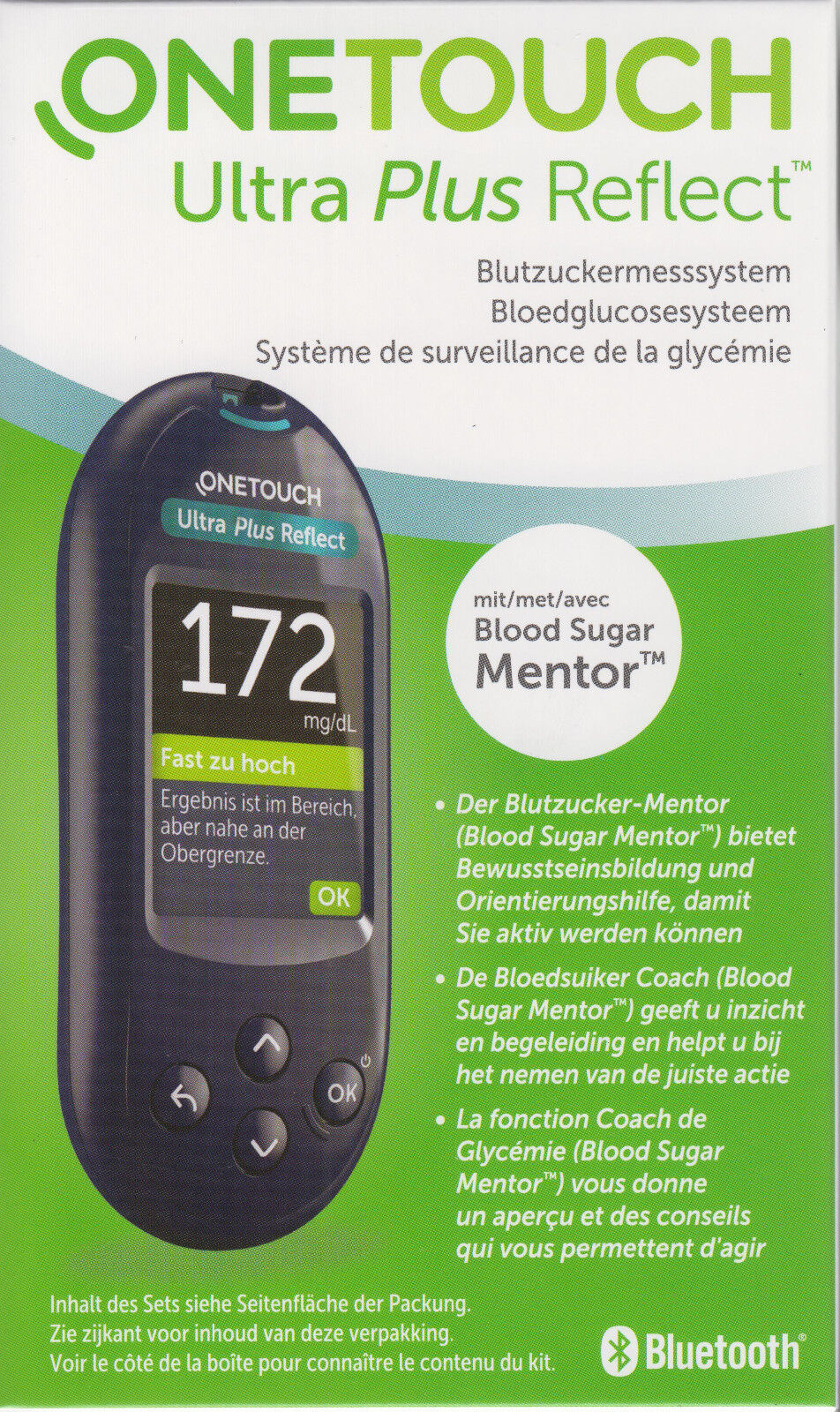

OneTouch Ultra Plus Reflect™ Blutzuckermessgerät mg/dl | Messgeräte | Blutzucker | Selbstkontrolle | DIABETES-SERVICE-ZENTRUM

OneTouch Ultra Plus Reflect Starter Set mg/dL: 1 Blutzuckermessgerät, 40 Teststreifen, 1 Lanzettengerät und 40 Lanzetten : Amazon.de: Drogerie & Körperpflege

OneTouch Ultra Plus Reflect Messgerät in mg/dL: Set zur Blutzucker-Kontrolle mit 1 Messgerät + 10 Teststreifen + 1 Lanzettengerät + 10 Lanzetten im Etui (inkl. Batterien) : Amazon.de: Drogerie & Körperpflege

Lifescan One Touch Ultra Plus Reflect mg/dl ab 14,95 € (Februar 2023 Preise) | Preisvergleich bei idealo.de

One Touch Ultra Plus Reflect Blutzuckermesssystem in mg/dl 1 St - Blutzuckermessgeräte - Blutzuckermessung - Diabetes - claras-apotheke.de